Child Tax Credit 2024 Canada Pay – Schedule 8812, “Additional Child Tax Credit Canada may be tax dependents but not CTC dependents.) Parents who earn more than $200,000, $400,000 if filing jointly, won’t be eligible for the full . For 2023 tax year, the maximum tax credit available per child is $2,000 for each child under 17 under Dec. 31, 2023, CNET reported. If you are eligible, it could reduce how much you owe in taxes but, .

Child Tax Credit 2024 Canada Pay

Source : twitter.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Samantha’s Law on X: “#Alberta Benefit Payment Dates. https://t.co

Source : twitter.com

$2000 State Child Tax Credit 2024 Payment Date & Eligibility News

Source : cwccareers.in

tax return 2023 canada|TikTok Search

Source : www.tiktok.com

25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com

Price Pucho Popular Pizzas

Source : pricepucho.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit Boost in USA What Can be the Increase in Child

Source : matricbseb.com

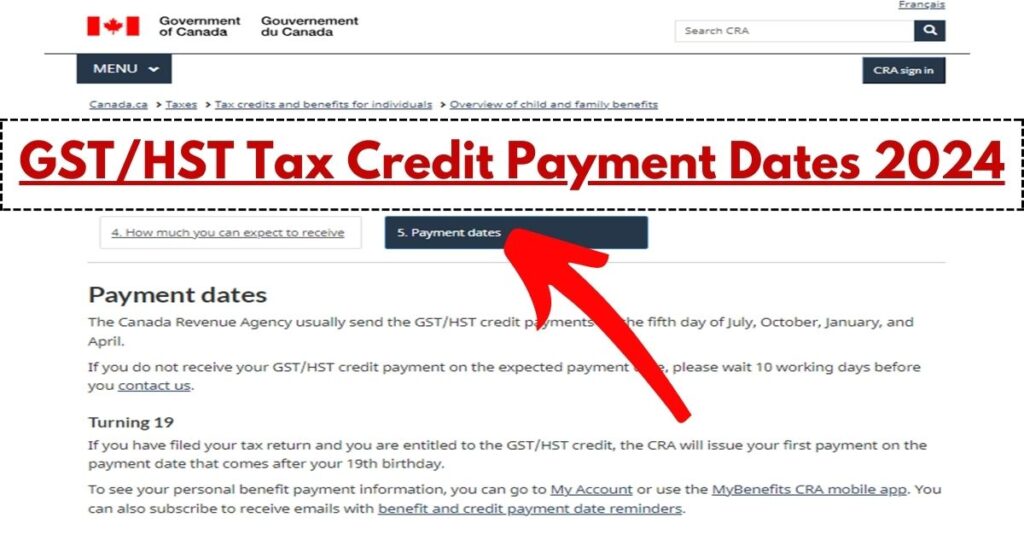

Canada GST/HST Tax Credit Payment Dates 2024: GST/HST credit

Source : bharti-axagi.co.in

Child Tax Credit 2024 Canada Pay Samantha’s Law on X: “#Alberta Benefit Payment Dates. https://t.co : Read on to discover 30 potential ways to pay less income tax in Canada you incurred child care costs for an eligible child, you can reduce your taxes using the childcare tax credit. . People filing in 2024 are filing for the year 2023. The Child Tax Credit offers support to as dependent in the form of a nonrefunded tax payment, although refunded child tax payments also .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)